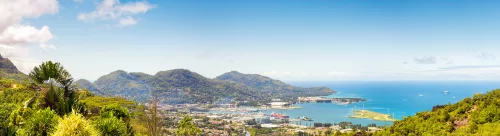

Mauritius, renowned for its robust regulatory framework and business-friendly environment, offers a compelling blend of transparency, security, and ease of operations. The Financial Services Commission (FSC) of Mauritius, the primary regulatory body, ensures that licensed entities adhere to international standards, thus fostering investor confidence and promoting a stable economic environment. As the forex trading industry continues to expand, Mauritius’ proactive regulatory approach and favorable tax regime make it an ideal jurisdiction for forex brokers and financial institutions aiming to leverage the growing opportunities in the forex market.

Mauritius, strategically situated in the Indian Ocean, plays a pivotal role in the global economy by offering financial licenses that can compete with top-tier jurisdictions. It is a comprehensive solution for brokerage businesses and investment advisors. Legalaes ensures that you comply with all forex licensing requirements in Mauritius by providing a guaranteed turnkey solution.

Regulations for Forex broker license in Mauritius

The regulation of financial forex related companies in Mauritius is overseen by the Financial Services Commission (FSC). The FSC is responsible for the licensing, supervision, and control of financial services – ensuring the protection of investors’ funds.

Obtaining a Forex broker license in Mauritius involves navigating a comprehensive regulatory framework designed to ensure transparency, security, and the integrity of the financial market. The regulatory authority overseeing this process is the Financial Services Commission (FSC) of Mauritius. Here are the key regulations and requirements for acquiring a Forex license in Mauritius:

1. Legal Framework and Licensing Requirements

1. Legal Framework and Licensing Requirements

- Financial Services Act 2007: This act provides the foundation for licensing and regulating financial service providers, including forex brokers.

- Securities Act 2005: It regulates securities transactions and the conduct of business in the financial services sector.

- Anti-Money Laundering and Combatting the Financing of Terrorism (AML/CFT): Applicants must comply with stringent AML/CFT regulations to prevent illicit activities.

2. Application Process

2. Application Process

- Incorporation: The entity must be incorporated in Mauritius as a Global Business Company (GBC).

- Application Submission: A detailed application must be submitted to the FSC, including business plans, operational procedures, and risk management strategies.

- Capital Requirements: A minimum stated capital is required, which varies based on the type of forex activities intended to be conducted.

- Fit and Proper Test: Directors, shareholders, and key personnel must pass a fit and proper test to ensure they have the necessary integrity, competence, and financial standing.

3. Operational and Compliance Requirements

3. Operational and Compliance Requirements

- Office and Local Presence: Maintaining a physical office and employing qualified local staff in Mauritius is mandatory.

- Risk Management: Implementation of robust risk management policies and procedures is essential.

- Reporting and Auditing: Regular financial reporting and annual audits by approved auditors are required to maintain transparency and regulatory compliance.

- Segregation of Funds: Client funds must be kept in segregated accounts to protect them from being used for operational purposes.

4. Ongoing Obligations

4. Ongoing Obligations

- Compliance: Continuous compliance with the FSC’s regulations, including periodic reporting and adherence to changes in regulatory requirements.

- Training and Development: Ongoing training programs for staff to keep them updated on the latest regulatory developments and market practices.

- Complaint Handling: Establishing a formal complaint handling mechanism to address client grievances promptly and effectively.

Acquiring a Forex broker license in Mauritius requires meticulous preparation and adherence to regulatory standards, but the benefits of operating within a well-regulated and strategically positioned jurisdiction can be substantial.

Types of Forex licensing in Mauritius

In Mauritius, the Financial Services Commission (FSC) is the primary regulatory body responsible for issuing licenses to forex brokers. The types of forex licensing available in Mauritius cater to various aspects of financial services, ensuring that entities comply with the relevant regulations and maintain a high standard of operations. Here are the main types of forex licensing available in Mauritius:

| License type | Description of license |

|---|---|

| Investment Dealer: Full service dealer (FSD) |

|

| Investment Dealer: Broker |

|

| Investment Dealer: Derivatives |

|

| Investment Dealer: Discount Broker |

|

| Investment Adviser: Unrestricted |

|

| Investment Adviser: Restricted |

|

Overview of requirements to obtain forex license in Mauritius

- Employ at least 2 local directors in Mauritius, AML officer (required personnel can be provided by Legalaes)

- Open bank account in a local bank

- Previous experience in financial background

- Share capital contribution from 14 000 USD

- Efficient business plan (can be prepared by Legalaes team)

- Comply with local laws

- Keep financial reports in Mauritius

- Conduct regular audits

Estimated time frames

Business name verification

1-5 days

Company formation

up to 2 weeks

Documents preparation

1 month

Forex license obtainment

3-4 months*

* The timeline also depends on the workload of FSC and any clarifications and queries that FSC may request in relation to the application.

Legal services for obtaining Forex broker license in Mauritius

Basic Package

20,000USD initial set up

- Turnkey company formation

- Registering share capital

- Legal address for 1 year

- Corporate documents

- AML/KYC policies and other internal documents

- HR services for appointing required local employees (Director, MLRO, Compliance)

- Search for business premises for rent

- Applying for the license and ongoing monitoring

Registration of the Forex Dealer licensed company under the minimum regulatory requirements

Additional services on request

- Bank account opening

- Business plan

- Adaptation of prepared documents

- Accounting services

- Legal opinion

- Assistance in opening bank account

- Setting up KYC/KYT provider

- Apostilled corporate documents

- Legal support

Ready-Made solution

available on request

- Registered company

- Legal address for 1 year

- No debts, no liabilities – clean company

- Registered share capital

- Active license

- Corporate documents

- Assistance with transfer of ownership

Jegor Kupratsevits

Head of Fintech

Requirements for Forex licensing in Mauritius

Obtaining a forex license in Mauritius involves submitting a comprehensive set of documents to demonstrate the applicant’s compliance with regulatory requirements and readiness to operate a forex trading business. Here is a detailed breakdown of the required documents:

List of required documents

- KYC Form: KYC form detailing the business activities, company name, registered address, shareholders, directors, key personnel and other relevant information.

- Purpose: Ensures the regulator has a clear understanding of the company’s structure and the individuals involved, facilitating the assessment of integrity and compliance.

- Business Plan

- Strategy: Outline the business strategy and goals.

- Financial Projections: Provide detailed financial forecasts, including income statements, balance sheets, and cash flow projections.

- Marketing Plans: Describe the marketing strategy to attract and retain clients.

- KYC Procedures: Explain the procedures for assessing client risk and ensuring compliance with anti-money laundering (AML) regulations.

- Purpose: Demonstrates the company’s viability, strategic planning, and commitment to regulatory compliance.

- Memorandum and Articles of Association (MAA)

- Memorandum of Association: States the company’s objectives and the scope of its activities.

- Articles of Association: Outlines the company’s governance structure, including the rights and responsibilities of directors and shareholders.

- Purpose: Legal documents required to register the company, defining its purpose and internal governance.

- Proof and Source of Funds

- Proof of Funds: Bank statements or other financial documents demonstrating the availability of the minimum required capital.

- Source of Funds: Documentation explaining the origin of the funds to ensure they are legitimate and comply with AML regulations.

- Purpose: Confirms the financial capability of the company to meet regulatory capital requirements and operate sustainably.

- Insurance

- Insurance Quote: Obtain a quote for business insurance that covers potential risks associated with forex trading.

- Purpose: Provides a safety net against operational risks and demonstrates the company’s commitment to mitigating potential financial losses.

- CVs of Key Personnel

- Detailed resumes of directors, shareholders, and key personnel as AML officers.

- Highlight qualifications, experience in the financial sector, and any relevant certifications.

- Purpose: Assesses the competency and expertise of the individuals in key roles, ensuring they have the necessary skills and experience to manage the business effectively.

- Personal Questionnaire (PQ) Form

- Personal and professional details of key personnel and shareholders.

- Information on previous employment, education, and any legal or regulatory issues.

- Purpose: Provides a comprehensive background check to assess the suitability, integrity, and fitness of individuals for their roles within the company.

- Implementation of Policies and procedures

- Internal Policies: Documentation of internal policies for risk management, compliance, client onboarding, and data security.

- Procedures: Detailed procedures for day-to-day operations, compliance checks, and handling client funds.

- Purpose: Ensures that the company has robust mechanisms in place to comply with regulatory requirements and operate with integrity.

- Platform and Liquidity Providers Information: Details of the trading platform and liquidity providers, demonstrating robust and secure trading infrastructure.

Share Capital and Government Fees

- Minimum Share Capital: The required minimum capital varies by the type of forex license in Mauritius – from MUR 500,000 up to MUR 10,000,000.

- Bank Account: Opening a local bank account in Mauritius is necessary for depositing share capital and handling transactions.

- Government Fees: The government processing, application, and registration fees for an Investment Dealer license in Mauritius range between USD 4,000 and USD 6,000, while the annual fee varies from USD 2,000 to USD 10,000, depending on the scope of activity.

Personnel Requirements

- AML Officer: Expert in AML regulations with experience in financial compliance. Certification in AML practices preferred.

- DMLRO: Knowledgeable in AML/CFT, supporting the AML Officer.

- Compliance Officers: Experienced in financial services compliance, understanding regulatory requirements.

- Two Local Directors: Residents of Mauritius with experience in financial management and corporate governance.

- Investment Dealer Team Members: At least two members with skills in investment dealing and financial analysis are required. Indicate if personnel are regulated, licensed, or have experience, providing evidence of such status if applicable.

- Auditor: The audit firm should be approved by the Financial Reporting Council (FRC)

Business premises requirements

- The forex licensed company in Mauritius is required to keep its accounting records at its registered office in Mauritius.

Roadmap of obtaining Forex license in Mauritius

For more detailed road map of the project and commercial offer – get in touch with our Forex professional.

Jegor Kupratsevits

Head of Fintech

Preparation

Collaboration with responsible stakeholders to perform due diligence. Creating necessary legal documents, agreements, business plan and compliance manuals. Reviewing contracts and issuing legal certificates. Preparing required documentation and application forms for submission.

HR Service of necessary local compliance team.

Our team will ensure to provide you with a range of options for a high-caliber local compliance team possessing the necessary experience in the field, essential for obtaining the licenses.

Submission

The application package is being submitted to both the FSC and ROC, while simultaneously initiating the process for opening a bank account

Follow up

Follow up with the authorities, addressing any inquiries posed by the FSC, until the issuance of the certificate of incorporation and license. Additionally, completing the bank account registration process by submitting the required documents to the bank.

Approval

The FSC grants approval, and the Registrar of Companies proceeds with the issuance of the Certificate of Incorporation. The initial board meeting is held to formalize the licensing conditions and the operational procedures for the bank account(s).

Bank account(s) Opening

Submitting the Certificate of Incorporation and FSC approval to the financial institution to finish corporate account opening and activation process.

Detailed Time Frames to Obtain a Forex License in Mauritius

The process of obtaining a forex license in Mauritius involves several stages, each with its own set of requirements and timelines. While the exact time frame can vary depending on the completeness of the application and the efficiency of the applicant in meeting the requirements, here is a general estimate of the time frames involved in obtaining a forex license in Mauritius:

1. Initial Preparation and Incorporation

Time Frame: 2-4 weeks

- Business Plan and Documentation: Preparing a detailed business plan, organizational structure, and required documentation.

- Company Incorporation: Incorporating the company in Mauritius as a Global Business Company (GBC). This includes registering the company with the Registrar of Companies, which typically takes about 1-2 weeks.

2. Application Submission

Time Frame: 2-4 weeks

- Compiling Application Package: Gathering all necessary documents, including the business plan, risk management policies, and information on directors and key personnel.

- Submission to FSC: Submitting the complete application package to the Financial Services Commission (FSC). This stage depends on how quickly the applicant can compile and submit the necessary documents.

3. FSC Review and Initial Assessment

Time Frame: 4-8 weeks

- Acknowledgement of Application: The FSC acknowledges receipt of the application and begins the initial review process.

- Initial Assessment: The FSC conducts an initial assessment of the application to ensure it meets the basic requirements. This stage can take 4-8 weeks, depending on the completeness and quality of the submission.

4. Detailed Review and Additional Information

Time Frame: 4-12 weeks

- Detailed Review: The FSC conducts a thorough review of the application, including a fit and proper assessment of directors and key personnel.

- Requests for Additional Information: The FSC may request additional information or clarification during the review process. The time taken to provide this information can affect the overall timeline.

- Compliance Checks: The FSC ensures that the applicant meets all regulatory requirements, including capital adequacy, risk management policies, and compliance with AML/CFT regulations.

5. Final Decision and Licensing

Time Frame: 2-4 weeks

- Final Review and Decision: After all queries are addressed, the FSC makes a final decision on the application. This can take 2-4 weeks.

- Issuance of License: If approved, the forex license is issued to the applicant. The company can then commence its forex trading operations in Mauritius.

Estimated Total Time Frame: 3-7 months

- Best Case Scenario: If the application is complete and meets all requirements without significant delays, the process can be completed in approximately 3 months.

- Typical Scenario: For most applicants, the process typically takes around 4-6 months, considering the time needed to address any additional information requests and complete all regulatory checks.

- Worst Case Scenario: If there are significant delays in providing additional information or meeting regulatory requirements, the process can extend up to 7 months or more.

Tips for Expediting the Process

- Thorough Preparation: Ensure all documentation is complete and accurate before submission to avoid delays.

- Engage Professional Services: Consider hiring legal and regulatory experts like Legalaes familiar with the FSC’s requirements to assist with the application process.

- Responsive Communication: Be prompt in responding to any requests for additional information from the FSC.

By following these guidelines and preparing thoroughly, applicants can help ensure a smoother and more efficient licensing process in Mauritius.

Advantages of registration Forex company in Mauritius

Registering a Forex company in Mauritius offers numerous advantages due to the country’s strategic positioning, favorable regulatory environment, and business-friendly policies. Here are the key benefits:

01

Regulatory Credibility

Operate under the oversight of the Financial Services Commission (FSC), boosting credibility and investor trust.

- Financial Services Commission (FSC): The FSC provides a well-structured and transparent regulatory framework that ensures high standards of operation and investor protection.

- Compliance with International Standards: Mauritius adheres to international best practices in financial regulation, enhancing the credibility and trustworthiness of licensed companies.

02

Favorable Tax Regime

Low Corporate Tax Rate: The standard corporate tax rate in Mauritius is 15%, but forex companies can benefit from an 80% partial exemption on certain income, effectively reducing the tax rate to 3%.

No Capital Gains Tax: Mauritius does not impose capital gains tax, allowing companies to retain more of their earnings.

Tax Treaties: The country has an extensive network of double taxation avoidance treaties (DTAs) with many countries, which helps minimize tax liabilities on cross-border transactions.

03

Reasonable Timeframes

The Financial Service Commission is motivated to issue licenses to foreign investors, making the process much smoother compared to other jurisdictions.

04

Benefit from a minimal share capital

Start with $14,000 USD in share capital to obtain a license.

05

Remote Management

Efficiently manage your forex business fully remotely.

06

Strong Banking Sector

Mauritius’ well-regulated banking sector offers multi-currency accounts, efficient fund transfers, and advanced technology for secure transactions.

07

Strategic Geographic Location

Global Access: Located at the crossroads of Africa, Asia, and Europe, Mauritius provides strategic access to these major markets.

Time Zone Advantage: The time zone (GMT+4) allows for extended trading hours, bridging the gap between Asian and European markets.

08

Business-Friendly Environment

Ease of Doing Business: Mauritius ranks high in global ease of doing business indices, with straightforward processes for company incorporation and licensing.

Political and Economic Stability: The country boasts a stable political environment and a growing economy, providing a secure foundation for business operations.

09

Skilled Workforce and Local Expertise

Qualified Professionals: Mauritius has a pool of highly skilled professionals in finance, law, and accounting, providing valuable local expertise.

Multilingual Workforce: The multilingual (English, French, and other languages) workforce facilitates smooth communication with international clients and partners.

10

Modern Infrastructure

Technological Advancements: Mauritius offers advanced IT and telecommunications infrastructure, essential for running a forex business efficiently.

Office Space and Facilities: The country has well-developed business parks and commercial spaces suitable for financial services companies.

11

Economic Substance Requirements

Genuine Operations: By requiring companies to have a physical presence and local staff, Mauritius ensures that businesses genuinely operate within the country, enhancing their credibility.

Reputation: Meeting economic substance requirements improves the company’s reputation and alignment with international regulations.

12

Investment Incentives

Freeport Zones: Businesses operating in freeport zones enjoy additional tax benefits and incentives, enhancing profitability.

Government Support: The government actively supports financial services and innovation, providing various incentives for investment.

13

Regulatory Support and Innovation

FinTech and Innovation: Mauritius is supportive of fintech innovations and regulatory sandboxes, providing an environment conducive to the growth of cutting-edge financial services.

Ongoing Support: The FSC and other regulatory bodies offer continuous support and guidance to ensure companies remain compliant and can adapt to regulatory changes.

14

Client Confidence

Transparency and Accountability: The regulatory framework emphasizes transparency, accountability, and investor protection, fostering client trust.

AML/CFT Compliance: Strict anti-money laundering (AML) and combatting the financing of terrorism (CFT) regulations enhance the integrity and security of the financial sector.

Links for legislation related to Forex business in Mauritius

Establishes the regulatory framework for securities and capital markets in Mauritius, defining the oversight and regulation of securities dealers, market operators, and the conduct of securities transactions. The Act aims to ensure fairness, efficiency, and transparency in the securities market, balancing the interests of issuers, investors, and intermediaries.

Provides a comprehensive legal structure for the supervision and regulation of non-banking financial services, including forex trading. The Act covers licensing requirements, the conduct of financial business, and the roles and responsibilities of the Financial Services Commission (FSC) in ensuring the integrity and stability of Mauritius’ financial system.

Regulates the incorporation, management, and administration of companies within Mauritius. It outlines the legal obligations of companies, directors, and shareholders, aiming to promote good governance, protect investors, and ensure corporate transparency and accountability.

Offers detailed guidelines for financial institutions on implementing effective AML/CFT measures. It outlines the principles, procedures, and controls required to prevent, detect, and report money laundering and terrorism financing activities, ensuring compliance with both local and international standards.

Details the specific requirements and standards that applicants must meet to obtain a forex license in Mauritius. This includes educational qualifications, financial requirements, operational capabilities, and adherence to regulatory and compliance norms. The criteria aim to ensure that only competent and financially sound entities can offer forex trading services to the public.

Taxation of Forex companies in Mauritius

The taxation regime for forex companies in Mauritius is designed to be favorable and competitive, attracting financial services providers to the jurisdiction. Here are the key aspects of the tax structure for forex companies operating in Mauritius:

1. Corporate Tax Rate

1. Corporate Tax Rate

- Standard Rate: The corporate tax rate for companies in Mauritius is 15%

- Partial Exemption Regime: Forex companies can benefit from an 80% partial exemption on specified income, effectively reducing the tax rate to 3%.

2. Global Business Companies (GBC)

2. Global Business Companies (GBC)

- GBC Structure: Forex companies often operate as Global Business Companies (GBC). These companies are eligible for a range of tax benefits, including the partial exemption regime.

- Foreign Tax Credit: GBCs can claim a foreign tax credit for taxes paid on foreign-sourced income, which can further reduce their effective tax rate.

3. Value-Added Tax (VAT)

3. Value-Added Tax (VAT)

VAT Rate: The standard VAT rate in Mauritius is 15%. However, financial services, including forex trading, are generally exempt from VAT.

4. No Capital Gains Tax

4. No Capital Gains Tax

Mauritius does not impose capital gains tax, which is beneficial for forex companies as they can retain more of their earnings from trading activities.

5. Withholding Tax

5. Withholding Tax

Dividends: There is no withholding tax on dividends paid to non-residents.

Interest and Royalties: Interest and royalty payments to non-residents are subject to withholding tax, but tax treaties may reduce these rates.

6. Double Taxation Avoidance Treaties (DTAs)

6. Double Taxation Avoidance Treaties (DTAs)

Mauritius has a wide network of double taxation avoidance treaties with numerous countries. These treaties help prevent double taxation and can provide tax relief and reduced withholding tax rates on cross-border transactions.

7. Economic Substance Requirements

7. Economic Substance Requirements

- Substance Requirements: To benefit from the favorable tax regime, forex companies must meet economic substance requirements. This includes having a physical office, employing local staff, and conducting core income-generating activities in Mauritius.

- Annual Reporting: Companies must demonstrate that they meet the substance requirements through annual reporting to the Mauritius Revenue Authority (MRA).

8. Tax Incentives and Benefits

8. Tax Incentives and Benefits

- Freeport Zones: Companies operating in designated freeport zones may benefit from additional tax incentives, including exemptions on corporate tax for certain periods.

- Investment Promotion Act: Companies can access various incentives under the Investment Promotion Act, aimed at promoting economic growth and investment in Mauritius.

9. Compliance and Reporting

9. Compliance and Reporting

- Tax Returns: Forex companies must file annual tax returns with the Mauritius Revenue Authority (MRA).

- Financial Statements: Audited financial statements must be submitted annually to ensure compliance with tax regulations.

The tax regime in Mauritius, characterized by a low effective corporate tax rate, the absence of capital gains tax, and extensive DTA network, makes it an attractive location for forex companies. These benefits, coupled with the requirement for economic substance, ensure that Mauritius remains a competitive and reputable jurisdiction for the global forex trading industry.

FAQ about Forex license in Mauritius

1. What makes Mauritius an attractive choice for a Forex License?

Choosing Mauritius for your Forex license offers several benefits, including its respected global standing, advantageous tax conditions, and a regulatory environment that balances strict oversight with accessibility for businesses.

2. Who requires a Forex trading license in Mauritius?

Any firm looking to engage in the forex market or offer investment services must secure a trading license in Mauritius to operate legally.

3. Can overseas companies apply for a Forex license in Mauritius?

Absolutely. International companies can apply for a Forex license in Mauritius, provided they establish a local office and comply with the regulatory requirements set by the Mauritian authorities.

4. What's the validity period of a Mauritius Forex license?

Initially, a Forex license in Mauritius is valid for one year. License holders can renew it annually, subject to continued compliance with regulatory standards and payment of the necessary renewal fees.

5. What kind of services can I offer with a financial license from Mauritius?

With a financial license from Mauritius, you can provide a range of services, including Forex trading, investment advisory, asset management, and brokerage services.

6. How much time does it take to secure a Forex license in Mauritius?

Typically, the process to secure a Forex license in Mauritius spans about three months. However, this timeline can extend if the regulatory body requests additional documentation or clarifications during the application review.