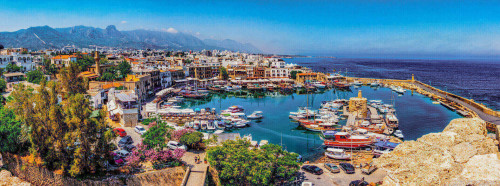

Cyprus, renowned for its strategic location, favorable tax regime, and robust legal framework, offers a thriving environment for businesses in the investment, forex, and broader financial services industry. A CySEC license in Cyprus not only enhances your firm’s credibility but also opens doors to the European markets under the MiFID II regulatory framework.

Securing a Forex license in Cyprus in 2024 represents a strategic move for financial firms seeking to establish a foothold in the burgeoning forex trading market. Cyprus has emerged as a premier destination for forex brokers due to its favorable regulatory environment, membership in the European Union, and robust financial infrastructure.

Governed by the Cyprus Securities and Exchange Commission (CySEC), the licensing process ensures that firms operate with transparency, integrity, and in compliance with European Union standards. As the forex market continues to expand globally, obtaining a CySEC license not only provides brokers with access to the European market but also instills confidence among traders and investors, offering a mark of credibility and reliability.

Regulations for Forex broker license in Cyprus

The Cyprus Securities and Exchange Commission (CySEC), established under the Cyprus Securities and Exchange Commission Law, passed in 2001, functions as the regulatory and supervisory body for finance-related entities in Cyprus. Its objectives include:

- Promoting Cyprus as a secure investment destination to enhance its competitiveness in the global financial market.

- Regulating and supervising the securities market, ensuring transparency and lawful operations among market participants.

- Enforcing compliance with financial regulations, setting and implementing rules to protect market integrity.

- Issuing and revoking licenses for financial entities to operate within Cyprus, ensuring they meet regulatory standards.

- Protecting investors by safeguarding their interests and maintaining a compensation fund for potential losses.

- Collaborating with international regulatory bodies to combat cross-border financial crimes and enhance regulatory frameworks.

Obtaining a Forex broker license in Cyprus involves navigating a comprehensive regulatory framework designed to ensure the integrity and stability of the financial market. The Cyprus Securities and Exchange Commission (CySEC) is the primary regulatory authority overseeing the licensing and supervision of Forex brokers. Here are the key regulations and requirements for securing a Forex broker license in Cyprus:

1. Legal Entity

1. Legal Entity

- The applicant must establish a Cyprus-based company, typically a Cyprus Investment Firm (CIF).

- The company must be incorporated and registered under Cyprus law.

2. Capital Requirements

2. Capital Requirements

- The minimum initial capital requirement is €125,000 for straight-through processing (STP) brokers.

- Market makers must maintain a minimum initial capital of €730,000.

3. Operational and Structural Requirements

3. Operational and Structural Requirements

- The firm must have a physical presence in Cyprus, including a fully operational office.

- Key personnel, including directors and compliance officers, must have the requisite qualifications and experience.

- A minimum of two executive and two non-executive directors must be appointed, ensuring the board has a balance of independent oversight.

4. Compliance and Risk Management

4. Compliance and Risk Management

- The firm must implement robust internal controls, risk management policies, and compliance procedures.

- Regular reporting to CySEC, including financial statements and risk management reports, is mandatory.

5. Client Protection and Transparency

5. Client Protection and Transparency

- Client funds must be segregated from the company’s operational funds to protect clients in case of insolvency.

- Detailed records of all transactions and communications must be maintained.

- Transparency in operations, with clear and fair trading terms and conditions, is required.

6. Anti-Money Laundering (AML) and Know Your Customer (KYC)

6. Anti-Money Laundering (AML) and Know Your Customer (KYC)

Strict adherence to AML and KYC regulations is mandatory, requiring thorough verification of clients’ identities and monitoring of suspicious activities.

7. Investor Compensation Fund (ICF)

7. Investor Compensation Fund (ICF)

Participation in the Investor Compensation Fund is required, which offers protection to clients in case the firm faces financial difficulties.

8. Application Process

8. Application Process

- Submission of a comprehensive application to CySEC, including detailed business plans, organizational structure, financial projections, and proof of capital.

- CySEC conducts a thorough review, which may include interviews with key personnel and on-site inspections.

9. Ongoing Obligations

9. Ongoing Obligations

- Continuous compliance with CySEC regulations, including annual audits, periodic regulatory reports, and updates on any significant changes in the firm’s operations.

- Ensuring all marketing and promotional activities are fair, not misleading, and comply with CySEC guidelines.

10. Fees

10. Fees

Payment of application fees and annual regulatory fees to CySEC.

Adhering to these regulations is essential for obtaining and maintaining a Forex broker license in Cyprus. The rigorous regulatory environment not only helps in establishing a reputable and trustworthy Forex brokerage but also provides a competitive edge by assuring clients and investors of the firm’s commitment to transparency and financial integrity.

Types of Forex licensing in Cyprus

| Forex activity | Description of activity |

|---|---|

| Reception and transmission of orders in relation to one or more financial instruments / Investment Advice | Receiving client orders and transmitting them to another entity for execution / Providing personal recommendations on financial instruments. |

| Reception and transmission of orders in relation to one or more financial instruments | Receiving and forwarding client orders for one or more financial instruments like shares, bonds, derivatives. |

| Execution of orders on behalf of clients | Executing orders for clients such as buying or selling financial instruments as per the client’s instructions. |

| Dealing on own account | Engaging in position-taking, trading with the firm’s own money for its own profit, rather than on behalf of a client. |

| Portfolio management | Managing portfolios of investments according to the clients’ objectives and mandates, including discretionary management. |

| Investment advice | Providing personalized recommendations to clients on financial instruments, investment strategies. |

| Underwriting of financial instruments and/or placing of financial instruments on a firm commitment basis | Committing to underwrite or place financial instruments on a firm commitment basis, typically involving initial public offerings or additional issuance. |

| Placing of financial instruments without a firm commitment basis | Placing financial instruments without taking them onto the firm’s own books, acting instead as an intermediary between the issuer and the investor. |

| Operation of Multilateral Trading Facilities (MTFs) | Operating facilities or systems that bring together multiple third-party buying and selling interests in financial instruments. |

Overview of requirements to obtain forex license in Cyprus

- Incorporate under the Cyprus Companies Act for legal operation

- Appoint at least eight team members, ensuring department heads are Cyprus residents

- Have at least four board members, including two independent non-executive and two executive directors, with a majority being Cyprus residents

- Secure a minimum paid-up capital of EUR 75,000

- Ensure all team members meet high standards of integrity and professional conduct

- Establish a physical presence in Cyprus for essential operations

- Contribute to the Investor Compensation Fund (ICF) as required for Cyprus Investment Firms (CIFs)

Estimated time frames to obtain forex license in Cyprus

Company formation

7-14 days

Documents preparation

4 weeks

License application and approval:

1) Fast track procedure

12-14 weeks*

2) Normal procedure

6-9 months*

* The timeline also depends on the workload of CySEC and any clarifications and queries that CySEC may request in relation to the application.

Legal services for obtaining Forex broker license in Cyprus

Basic Package

50,000EUR initial set up

- Name reservation

- Company Incorporation

- Legal address for 1 year

- Assistance with share capital contribution

- Corporate documents

- AML/KYC policies and other internal documents

- HR services for appointing required local employees (Director, MLRO, Compliance)

- Search for business premises for rent

- Applying for the license and ongoing monitoring

Registration of the Forex Dealer licensed company under the minimum regulatory requirements

Additional services on request

- Individual business plan

- Adaptation of prepared documents

- Accounting services

- Legal opinion

- Assistance in opening bank account

- Setting up KYC/KYT provider

- Apostilled corporate documents

- Legal support

Ready-Made solution

available on request

- Registered company

- Legal address for 1 year

- No debts, no liabilities – clean company

- Registered share capital

- Active license

- Corporate documents

- Assistance with transfer of ownership

Jegor Kupratsevits

Head of Fintech

Detailed Requirements for Forex licensing in Cyprus

Obtaining a Forex license in Cyprus involves a meticulous process overseen by the Cyprus Securities and Exchange Commission (CySEC), aimed at ensuring that financial firms operate with transparency, integrity, and adherence to EU regulatory standards. Below is list of the requirements and documents needed for Forex licensing in Cyprus:

List of required documents

- CVs of Shareholders and Team Members

- Purpose: To provide detailed backgrounds and professional qualifications of shareholders and key team members.

- Content: Should include education, professional experience, qualifications, and any relevant certifications in finance or related fields.

- Internal Operations and AML Manuals

- Purpose: Demonstrate compliance with EU regulations, specifically in anti-money laundering (AML) and operational practices.

- Content: Detailed manuals outlining internal procedures for AML measures, client onboarding, transaction monitoring, and reporting suspicious activities.

- Business Plan

- Purpose: Outline the company’s strategic vision, operational framework, target markets, and financial projections.

- Content: Includes detailed sections on service offerings, marketing strategy, organizational structure, risk management, and compliance frameworks.

- Proof and Source of Funds

- Purpose: Verify the financial capacity and operational liquidity of the applicant.

- Content: Documentation showing the source and availability of funds, ensuring they meet the minimum capital requirements set by CySEC.

- Product Governance and Target Market Assessment

- Purpose: Ensure that financial products and services are suitable for identified target markets and comply with governance standards.

- Content: Analysis of product features, market segmentation, distribution channels, and strategies for product lifecycle management.

- ICAAP (Internal Capital Adequacy Assessment Process)

- Purpose: Demonstrate the firm’s capability to assess and manage risks related to capital adequacy.

- Content: Documents detailing risk assessment methodologies, stress testing scenarios, and strategies for maintaining adequate capital buffers.

- CVs of Key Personnel

- Purpose: Assess the qualifications and experience of individuals in critical roles within the organization.

- Content: Resumes highlighting relevant skills, professional achievements, and regulatory experience in the financial sector.

- Insurance Quotation

- Purpose: Provide evidence of risk management measures through appropriate insurance coverage.

- Content: Documentation from an insurer outlining the types and coverage limits of insurance policies relevant to the firm’s operations.

- Fit and Proper Assessment

- Purpose: Evaluate the integrity, competence, and suitability of key individuals (e.g., shareholders, directors, and senior management) to hold positions of responsibility.

- Content: Questionnaires, background checks, and declarations confirming compliance with EU standards for financial services.

- Business Address Approval

- Purpose: Verify the physical presence of the company in Cyprus.

- Content: Documentation proving the existence of a principal business location, such as lease agreements or utility bills.

- Questionnaires

- Purpose: Gather detailed information about shareholders, directors, and senior management to assess their suitability and compliance with regulatory requirements.

- Content: Specific questions related to financial background, experience, integrity, and adherence to ethical standards.

Share Capital and Government Fees

- Minimum Share Capital: Requirement for share capital depends on activity planned under the forex broker license in Cyprus:

– Investment Advice and R&T (no safekeeping): €75,000;

– Brokerage (safekeeping): €150,000;

– Market Maker / Principal: €730,000. - Government Fees: Ranging from €8,000 to €9,000 depending on the type of investment license in Cyprus.

- Fast Track Option: Fast Track process option available for €25,000 (government fee).

Personnel Requirements

- Executive Directors: Minimum of two persons required. Responsible for overseeing day-to-day management and operational decisions, ensuring the execution of strategic plans, and achieving organizational objectives.

- Independent Non-Executive Directors: Minimum of two persons required. Tasked with offering independent oversight and strategic guidance without being directly involved in day-to-day operations.

- Compliance and AML Officer: Responsible for maintaining regulatory standards and anti-money laundering protocols.

- Head of Investment Service: Oversees all investment services and operations.

- Head of Backoffice: Manages back-office operations and support systems.

- Internal Audit: Conducts internal reviews and audits to ensure compliance and operational integrity.

- Accounting and Payroll: Manages financial records and payroll systems.

- External Audit: Engages with external auditors to ensure financial transparency and regulatory compliance.

- Legal Adviser: Provides legal guidance and ensures compliance with local and international laws.

Not sure about the number of staff you need to employ for your Forex project? Contact Legalaes experts to define the right personnel structure for your business model.

Business premises requirements

- For obtaining forex license in Cyprus, it’s required to have a physical office to facilitate data storage and provide a working space for staff, reinforcing the operational base in Cyprus.

Roadmap of obtaining Forex license in Cyprus

For more detailed road map of the project and commercial offer – get in touch with our Forex professional.

Jegor Kupratsevits

Head of Fintech

Initial Setup

A company must be incorporated under the Cyprus Companies Act, setting a clear shareholder structure and defining team roles, essential for compliance with local regulations.

Documents Prepration

In collaboration with the client, essential documents such as agreements, business plans, and compliance manuals are prepared, all tailored to meet the specific regulations of Cyprus. This comprehensive package is crucial for the successful submission to the Cyprus Securities and Exchange Commission (CySEC).

Submission

The complete application pack, along with the necessary fees, is submitted to CySEC, marking the formal request for licensing.

Staff HR

Legalaes provides options for hiring experienced local compliance teams who are well-versed with the Cyprus regulatory environment, supporting the recruitment process to ensure all personnel meet CySEC’s requirements.

Follow-Up

Regular interactions with CySEC are vital to address any clarifications or additional information requests. CySEC assigns an officer to manage the application process, typically involving 2-4 rounds of questions for clarification.

Conditional Approval

Following a thorough review, CySEC may issue conditional approval, requiring the company to meet certain stipulations. The company must then submit evidence of compliance with these conditions to move forward.

CySEC Visit

A CySEC representative conducts an onsite visit to verify the company’s adherence to the stipulated conditions, ensuring the operational substance of the office in Cyprus.

Final Approval

Upon satisfactory completion of all requirements and verification, CySEC grants final approval, allowing the company to immediately commence providing services under its regulatory framework.

Detailed Time Frames to Obtain a Forex License in Cyprus

The estimated time frame to obtain a forex license in Cyprus can vary based on several factors, including the completeness of the application, the complexity of the business model, and the responsiveness of the applicant in fulfilling regulatory requirements. Generally, the process can be broken down into the following stages with approximate time frames:

1. Preparation Stage

Time Frame: 1-2 months depending on preparedness

This involves preparing all necessary documentation, business plans, and ensuring compliance with regulatory requirements.

2. Submission of Application to CySEC

Time Frame: 1-2 weeks assuming documents are in order

Once all documents are prepared, the formal application is submitted to CySEC.

3. Initial Review by CySEC

Time Frame: 2-3 months

CySEC conducts an initial review to assess the completeness of the application and may request additional information or clarifications.

4. Additional Requests and Clarifications

Time Frame: 1-2 months depending on the complexity of the requests

CySEC may request further documentation or seek clarifications on aspects of the application.

5. On-Site Inspection (if required)

Time Frame: 1-2 months if required

CySEC may conduct an on-site inspection of the applicant’s premises and operations to ensure compliance with regulatory standards.

6. Final Decision by CySEC

Time Frame: 1-2 months

After completing the review process and addressing any outstanding issues, CySEC makes a final decision on the license application.

Overall, the entire process from the initial preparation stage to obtaining a forex license in Cyprus typically ranges from 6 months to 1 year. The actual timeline can vary based on the complexity of the application, the responsiveness of the applicant, and any specific requirements imposed by CySEC during the review process. It’s important for applicants to engage with experienced legal and financial advisors to navigate the regulatory framework effectively and expedite the licensing process where possible.

Advantages of registration Forex company in Cyprus

01

EU Membership

As a member of the European Union, Cyprus offers firms a passport to provide services across all EU and EEA countries. This makes it an attractive base for companies looking to access the European market.

02

Favorable Tax Regime

Cyprus has one of the lowest corporate tax rates in the EU at 12.5%. It also has a network of double tax treaties with over 60 countries, providing tax-efficient structures for international business. Dividend income, profits from the disposal of securities, and profits from permanent establishments abroad are often exempt from tax.

03

Regulatory Framework

The Cyprus Securities and Exchange Commission (CySEC) is aligned with EU financial regulations, providing a robust yet business-friendly regulatory environment. The implementation of MiFID II has enhanced customer protection and increased the transparency of financial services across Europe.

04

Strategic Location

Situated at the crossroads of Europe, Asia, and Africa, Cyprus has a strategic geographical location that allows for easy access to a variety of markets.

05

Skilled Workforce

Cyprus has a well-educated, multilingual workforce, particularly in legal, financial, and business services, which is essential for companies that need skilled professionals.

06

Advanced Infrastructure

The country has a modern telecommunications infrastructure and a well-developed legal and banking sector, which are crucial for the smooth operation of financial services firms.

07

Efficient Legal System

Cyprus boasts a well-established legal system based on English common law principles, providing clarity and predictability for businesses. The judicial system is supportive of commercial disputes, offering a reliable environment for resolving legal issues.

08

Stable Economic and Political Environment

Cyprus maintains a stable economic and political environment, fostering confidence among investors and businesses. The country’s commitment to fiscal discipline and economic stability further enhances its attractiveness as a business hub.

09

English Language and Business Culture

English is widely spoken and used in business, legal, and official contexts in Cyprus. This facilitates communication and business dealings with international clients and partners, easing market entry and expansion.

10

Supportive Business Environment

The Cypriot government actively supports foreign investment and business development through various incentives, grants, and programs aimed at promoting economic growth and diversification.

These advantages collectively make Cyprus a preferred jurisdiction for registering a Forex company, offering a combination of regulatory credibility, tax efficiency, strategic location, and a supportive business environment conducive to long-term success and growth in the financial services sector.

Links for legislation related to Forex business in Cyprus

Prevention of Money Laundering and Financing of Terrorism Act: Establishes the legal framework to combat money laundering and terrorism financing in Cyprus. This act outlines the responsibilities of financial institutions in identifying, preventing, and reporting activities suspected of being related to financial crimes.

II. Law 87(I)/2017

Law 87(I)/2017 (Investment Services Law): Provides the legal foundation for the provision of investment services, the exercise of investment activities, the operation of regulated markets, and other related matters in Cyprus, ensuring compliance with European standards.

III. Cyprus Companies Act

Cyprus Companies Act: Governs the incorporation, regulation, and dissolution of companies in Cyprus. This act facilitates ease of doing business and provides a framework for the establishment and operation of both local and international companies.

The Cyprus Stock Exchange Law: Regulates the operations of the Cyprus Stock Exchange, outlining the legal requirements for trading and listing securities to ensure transparent and fair markets.

V. MiFID II

Directive 2014/65/EU – MiFID II: Directive of the European Parliament and of the Council on markets in financial instruments, revising trading processes and enhancing transparency across the EU financial markets.

MiFIR Guidelines: Outlines obligations regarding market data under the Markets in Financial Instruments Regulation, ensuring data reporting and transparency requirements are met by all participating entities.

Regulation (EU) No 600/2014 – MiFIR: Complements Directive 2014/65/EU, setting out requirements related to the disclosure of trade data to the public and transaction execution obligations in financial markets.

Taxation of Forex Companies in Cyprus

Taxation for forex companies in Cyprus is structured to provide a favorable business environment while ensuring compliance with both local and international tax regulations. The key aspects of taxation for forex companies in Cyprus include:

1. Corporate Tax Rate

1. Corporate Tax Rate

The standard corporate tax rate in Cyprus is 12.5%, one of the lowest in the European Union. This rate applies to the net profits of forex companies.

2. Value Added Tax (VAT)

2. Value Added Tax (VAT)

Forex trading activities are generally exempt from VAT in Cyprus. However, forex companies must register for VAT if they engage in other VATable activities.

3. Withholding Tax

3. Withholding Tax

- Cyprus does not impose withholding tax on dividends paid to non-resident shareholders.

- There is no withholding tax on interest payments made abroad, except in specific circumstances related to government bonds.

- Royalties paid to non-residents for rights used outside Cyprus are also exempt from withholding tax.

4. Dividends

4. Dividends

- Dividends received by a Cyprus tax resident company from another Cyprus tax resident company are generally exempt from corporate income tax.

- Dividends received from foreign subsidiaries may also be exempt, provided certain conditions related to participation and tax are met.

5. Capital Gains Tax

5. Capital Gains Tax

- Cyprus does not levy capital gains tax on profits from the sale of securities, including shares in forex companies.

- Gains from the disposal of real estate located in Cyprus or shares in companies holding such property are subject to capital gains tax at 20%.

6. Special Defense Contribution (SDC)

6. Special Defense Contribution (SDC)

- SDC is levied on passive income, including dividends, interest, and rents. However, forex companies are typically exempt from SDC on dividends and interest income.

- The current SDC rate is 17% on dividends, 30% on interest income, and 3% on rental income, but exemptions may apply.

7. Intellectual Property (IP) Regime

7. Intellectual Property (IP) Regime

Cyprus offers an attractive IP regime where qualifying IP income benefits from an effective tax rate of 2.5%, promoting the development and management of IP assets.

8. Loss Carryforward

8. Loss Carryforward

Tax losses incurred by forex companies can be carried forward for up to five years to offset future taxable profits.

9. Group Relief

9. Group Relief

Companies within the same group can offset losses against profits of other group members, providing tax planning flexibility.

10. Double Taxation Treaties (DTT)

10. Double Taxation Treaties (DTT)

Cyprus has an extensive network of double taxation treaties with over 60 countries, minimizing the risk of double taxation and facilitating international business.

11. Tax Incentives

11. Tax Incentives

Various incentives are available for foreign investors and businesses, including tax deductions for business expenses and investment allowances.

FAQ about Forex license in Cyprus

1. Why choose Cyprus for setting up your investment firm?

Cyprus is renowned for its CySEC license, which is highly prestigious within the financial community. The license offers EU passporting rights, making it a strategic choice for firms looking to establish a memorable presence and expand into the EU market.

2. Who can apply for a Cyprus Investment Firm (CIF) License?

The ideal candidate for a CIF license is an investment firm with a pristine reputation and extensive experience in the field. Cyprus is known for its stringent licensing requirements, which confer prestige and open up significant opportunities.

3. How long does it take to get licensed by CySEC?

The licensing process in Cyprus can take anywhere from 6 to 14 months, influenced by factors such as your project's dedication, the current workload at CySEC, and whether you opt for the fast-track application process.

4. I have a license in another country; would it be useful?

Yes, having a license from another country is helpful because it shows you meet high standards of regulation. This could make your application process in Cyprus smoother and give your firm an advantage.

5. Should I establish an office in Cyprus?

Yes, establishing a physical office in Cyprus is necessary. It serves as a base for keeping documentation and provides a workplace for your staff, fulfilling regulatory requirements to ensure operational legitimacy.